From Insight to Foresight: Building a forward-looking finance function

Most analytics efforts explain what happened, but the real value comes when teams start exploring what could happen next. That is where foresight begins by using clean, connected data and structured logic to test scenarios, measure sensitivities, and prepare for change before it happens.

Modern finance teams go beyond reporting results. They model outcomes. The same foundation that powers Business Intelligence now supports business foresight. Through scenario analysis, driver-based planning, and dynamic forecasting, decision makers can see how every assumption affects performance in real time.

Shifting from reactive to proactive

Traditional finance functions often operate in a reactive mode: consolidating results, reconciling actuals, and producing reports after the fact. But the world moves faster than reporting cycles. In volatile markets, a backward view is not enough.

The shift to proactive finance comes down to three changes transforming leading FP&A teams today:

- Shorter cycles and continuous updates. Annual budgets are too slow for a world that changes monthly. Many organizations now replace the once-a-year budget with a rolling 12- or 18-month forecast that updates key assumptions each quarter. Others use monthly iterative forecasts focused on a few critical drivers like revenue, headcount, and cash. The result is less time spent locking in a plan and more time steering it.

- Integrated, cross-functional planning. Finance cannot operate in isolation. Workday’s 2025 CFO Trends report notes that the most advanced FP&A teams now partner directly with operations, sales, and supply chain to anticipate the impact of decisions across the enterprise. In practice, this means aligning financial forecasts with operational metrics, for example linking production schedules to revenue timing or staffing plans to demand forecasts, so that every function works from the same set of assumptions (Workday).

- Data and technology enabling foresight. Modern tools allow finance to test scenarios, visualize sensitivities, and predict what might happen next. Cloud-based planning platforms, predictive modeling tools, and automation are making it easier to simulate outcomes in real time. Teams that used to spend weeks consolidating spreadsheets can now reforecast in hours, freeing time to analyze results and recommend actions.

Explaining the past is necessary, but not sufficient. Proactive finance means preparing for the unexpected, testing possibilities, and making decisions with the future in view, not simply reacting when the flashpoint arrives.

Scenario modeling: the sandbox for strategy

Scenario modeling gives finance a way to test strategies before they hit the real world. It is not intended to predict a single outcome. It is exploring how different futures would affect results and preparing for the ones that matter most.

Most teams work with three to five distinct cases, like base, upside, and downside scenarios, or possible “black swan events”. The goal is to see how the plan performs under these different storylines. The FP&A Trends network describes this as readiness, not prediction: the discipline of preparing for several credible futures rather than relying on one expected path.

Effective models focus on the few assumptions that truly drive performance, such as prices, volumes, interest rates, and cost inflation. Linking these inputs to cash flow, margin, and liquidity shows where the plan is resilient and where it is exposed.

Three practices make scenario modeling effective:

- Define the purpose. Start every scenario with a decision in mind. Ask, what question are we trying to answer? For example, “Should we expand the sales team next quarter?” or “Can we absorb a 10 percent cost increase without cutting investment?” Then build only the variables needed to answer that question. Use clear naming conventions in your model (for example “Scenario_01_GrowthPush” or “Scenario_02_SupplyShock”) so everyone knows what is being tested. Limit the scope so leadership can act on the insight in one meeting.

- Use consistent data. Build scenarios directly off the same data pipelines and model structures used for reporting and forecasting, not offline spreadsheets. Tag versions in your planning tool or model repository so assumptions, data sources, and time stamps are traceable. When finance and operations both pull from the same definitions of revenue, cost, and volume, reviews focus on actions instead of reconciling numbers.

- Update frequently. Treat scenario updates as part of your forecasting cadence. Many teams run a light “scenario pulse” each month using the latest actuals and key driver movements, and a deeper refresh each quarter tied to board or strategy reviews. Establish trigger points such as when the revenue run rate shifts by more than five percent or when commodity prices move outside the expected range, so new scenarios generate automatically. Keep the inputs simple enough that updates take hours, not weeks.

Scenario modeling helps leaders weigh trade-offs, make faster adjustments, and build resilience before the next disruption arrives.

Driver based planning: making assumptions explicit

Scenario modeling shows what could happen. Driver based planning uncovers why and sometimes challenges what we thought we knew.

Driver based planning makes the math visible. It connects results to the operational levers that create them, like price, volume, headcount, utilization, conversion rate, and production yield. Linking KPIs to these drivers helps leaders see how performance shifts when the business changes.

The hard part is identifying the right drivers. Many organizations start with what is easy to measure or what has always been tracked. But they key comes from testing those assumptions with data and being willing to challenge convention.

A useful parallel comes from sabermetrics, the data driven approach to baseball popularized in Moneyball by Michael Lewis. Analysts found that on base percentage explained more wins than batting average, overturning decades of intuition. Finance faces the same challenge: looking beyond familiar metrics to uncover what truly drives performance.

The goal is not to model every variable, just to prioritize the critical drivers that matter most. For revenue, that might be customer count, average price, and churn. For labor, it might be headcount, salary rate, and productivity. When those relationships are clear and validated, forecasting becomes faster, more accurate, and easier to explain.

Some suggestions on how to get started:

- Start with a value driver tree. Document the cause-and-effect links between key metrics. For example, revenue = volume × price; volume = customers × average order size. A simple diagram or table is enough. This exercise exposes gaps where drivers are unclear or duplicated across departments. It also often surfaces insights that challenge intuition. The metrics everyone tracks are not always the ones that truly drive results. The Driver-Based Planning: Elevating FP&A report from KPMG shows how value driver trees link strategic goals to operational decisions.

- Validate the math. Reconcile model logic with historical data to confirm that driver relationships make sense. If sales volume historically drives 70 percent of margin changes, but your model shows 30, something is off.

- Make drivers system visible. Use dashboards or reports where drivers are transparent and editable by business owners. Lock formulas that define structure but allow teams to update assumptions directly.

- Build ownership. Assign each major driver to a responsible function. Sales owns price, HR owns headcount, operations owns productivity. This turns planning into a shared process rather than a finance only exercise.

After mapping the main drivers, the next step is to understand how sensitive results are when those drivers move.

Sensitivity and what-if analysis: quantifying uncertainty

Sensitivity analysis helps finance quantify how changes in assumptions affect results. As FP&A author Jack Alexander notes in Apliqo’s 9 FP&A Best Practices Every CFO Needs to Know, sensitivity analysis is one of the most valuable tools in finance because it exposes key assumptions and quantifies risk.

A well-built model lets teams test one variable at a time to understand its impact on profit, cash flow, or any chosen KPI. For example, if a five percent change in volume moves operating income by twenty percent while a similar change in price barely registers, you know where the leverage really is.

To put this into practice:

- Start with single-factor tests. Change one driver and review the isolated effect. This can be as simple as adjusting a variable and observing the output. It creates a clear ranking of which assumptions have the largest influence.

- Expand to multi-factor scenarios. Once the key sensitivities are known, test combinations. For instance, lower demand and higher costs at the same time. This shows how risks interact.

- Visualize results. Waterfall charts, tornado charts, and spider plots make it easy to show which variables have the biggest impact. A single image can often convey what dozens of tables cannot.

- Use sensitivity results to guide effort. Variables that have little effect can be simplified or fixed; those that swing outcomes deserve closer monitoring, better data, or more frequent updates.

The purpose is not to predict exactly what will happen, but to understand how exposed the business is when the environment shifts. When uncertainty can be quantified, it can be managed.

Predictive forecasting: from guesswork to guidance

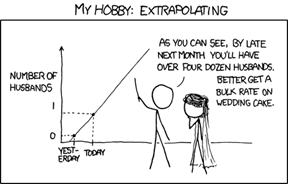

That XKCD comic nails a common error in forecasting: drawing a straight line from yesterday to tomorrow and calling it predictive. Real foresight requires more than extrapolation.

Predictive forecasting applies machine learning and statistical techniques to anticipate future outcomes based on historical data. These models analyze patterns, measure uncertainty, and produce guidance that finance teams can interpret and refine. Effective forecasting goes beyond simple trend extension into quantifying confidence, testing accuracy, and understanding where predictions carry risk. By validating models statistically and interpreting them through business context, finance moves from guesswork to guidance.

Some steps you can follow in developing predictive forecasting capabilities:

- Start with foundational models. Simple regressions or time-series methods provide a baseline and help build trust. They also surface data quality issues early. Use quantitative measures such as Mean Absolute Percentage Error (MAPE) or Root Mean Squared Error (RMSE) to benchmark accuracy before introducing more complex techniques.

- Introduce probabilistic techniques. Once accuracy and understanding are established, layer in simulations or algorithms that estimate distributions rather than single points. This could mean Monte Carlo, Bayesian methods, or ensemble models that express confidence intervals. Evaluate model fit using criteria like Akaike Information Criterion (AIC) or Bayesian Information Criterion (BIC) to ensure added complexity actually improves performance.

- Adopt automation tools. Many teams now use AutoML or AutoAI platforms to test multiple algorithms and select the best-performing one automatically. These systems handle tuning and validation, letting finance teams shift focus from coding to interpretating the results.

- Expand the feature set. Move beyond internal historicals by feeding models external data such as market trends, macro indicators, or customer sentiment. This increases predictive power and helps detect turning points sooner.

- Keep humans in control. Predictive models highlight statistical patterns; finance professionals provide context. When reviewing results, consider business-specific trade-offs. For instance, in many retail contexts, the cost of under-forecasting demand exceeds the cost of over-forecasting, since lost sales are often more expensive than carrying extra inventory. The reverse can also be true where holding or spoilage costs are high. Every forecast should be reviewed with domain insight before it informs planning decisions.

Predictive forecasting replaces intuition with evidence while keeping human judgment at the center. It turns history into probabilities, helps teams manage uncertainty, and provides forward-looking guidance that makes planning a strategic advantage.

The human loop: why foresight is not full automation

We are not talking about handing the wheel to machines but rather giving finance better instruments to steer. Models can learn from the past, run faster, and process more variables than any analyst, but they still need human judgment to interpret, challenge, and act. McKinsey’s State of AI 2025 report makes the same point, noting that artificial intelligence cannot replace human interpretation in complex domains like strategy, and that the real advantage lies in how people and machines make decisions together.

Predictive systems are only as useful as the context around them. A model might flag a downward trend in margin, but it cannot know that a new product launch or supplier change will reverse it. Data can show correlation, but only people understand intent, timing, and risk appetite.

How to keep humans in the loop:

- Treat models as copilots, not pilots. Use AI to surface insights and scenarios but let finance decide which ones matter and how to respond. Models inform decisions. They don’t make them.

- Require explainability. Every prediction or recommendation should be traceable to its logic and inputs. If a model’s reasoning cannot be explained, it cannot be trusted.

- Institutionalize review cycles. Build checkpoints where analysts and business partners review model outputs together, compare them with current realities, and record any overrides or rationale. This keeps accountability visible.

- Balance automation with intuition. Automate the repetitive data prep, model runs, and report generation, Reserve human time for framing questions, interpreting results, and debating strategy.

- Invest in analytical literacy. The more people understand how models work, the better they can challenge them. Upskill teams to read patterns, question bias, and translate statistical outputs into business action.

AI can generate speed and scale, but judgment gives direction. Foresight is strongest when computational power and human perspective work together.

The payoff: agility, confidence, and resilience

Foresight turns planning into an ongoing conversation, not an annual ritual. It replaces rigid cycles with continuous learning, where each forecast, scenario, and model makes the organization a little faster and a little smarter.

The real value is not better predictions. It is the confidence that comes from understanding how the business responds to change. As author Karl Schroeder put it, “foresight is not about predicting the future. It is about minimizing surprise.” Finance gains agility to act sooner, clarity to focus effort where it matters, and resilience to adapt when the unexpected happens.

The next article in the Next Wave series explores how to make that collaboration effortless, where anyone can ask a question, explore a scenario, and act on insight directly.